Coupa: Thoma Bravo Attracts Another Sell-Out

Corporate Governance Is the Greatest Takeout Show on Earth

“No one ever went broke overestimating the intelligence of the public shareholder.”

At first glance, corporate governance appears boring, but don’t let the boilerplate language deceive you.

This is a world where you’ll see things you’ve never seen before; witness fiduciary defying acts that you think are impossible. It’s a wonderful circus filled with compensation oddities, clown show stewardship, and some of the greatest showmen in finance.

Join me as I walk through Thoma Bravo’s announced $8 billion acquisition of Coupa Software, and show you why corporate governance is the greatest takeout show on Earth.

Shameless Plug

If you enjoy this write-up, check out the Premium Newsletter where I wrote a more “nuanced” analysis of Coupa and strategic alternatives signals [Paywall] last month.

Premium explores “real time” situations and looks for interesting governance signals, like indicators of strategic options and other noteworthy inflections, before they potentially happen and/or gets priced in.

Note: If you previously subscribed to premium, a friendly reminder you were issued a pro-rated refund in February 2022 and will need to re-subscribe to receive premium emails again.

Welcome to the Governance Circus

Corporate governance is supposed to be a “fair” game, but agency cost has a way of changing the shape of the “basketball rim” to favor insiders. Anyone who has played carnie basketball knows what I’m talking about:

Image: “Georgia National Fair 2016” by Michael Rivera is licensed under CC BY-SA 4.0.

Spend enough time observing governance “games”, especially in tech, and you’ll quickly learn playing against the carnies* is a losing proposition long-term. Luckily, you too can take advantage of bent rims in corporate governance.

Frankly, why play against the carnies when you play alongside them?

* Please consider this a lighthearted ribbing. Not my intent to offend carnies.

P.T. Bravo: The Greatest Takeout Showman

Tech PE investors have arguably mastered the art of “playing alongside the carnies” to pursue takeout opportunities. They have a real knack for finding and attracting sell-outs.

In particular, Thoma Bravo is arguably the greatest takeout showman in tech. Respect.

They’re like the “P.T. Barnum of takeouts” if you will. I fondly call them “P.T. Bravo” given their profit-focused agenda (get it…P.T. Bravo…Profit-focused Thoma Bravo).

So how does tech PE “play alongside the carnies”?

Tech PE offers a lucrative solution (i.e. takeout with accelerated vesting and/or post deal retention packages) to “address” bloated operating expenses and protect insiders from unsatisfied public shareholders demanding meaningful changes (which may include firing management).

Orlando Bravo frames the situation pretty well:

In my opinion, a significant percentage of public SaaS companies have optimized their operating expenses in a way that can’t handle a full business cycle. Many public companies are great at optimizing for a bull-market and “optionality”, but it remains to be seen how many can actually self-fund and execute through a down-market as currently constructed.

This creates a situation where you have bloated opex structures that require “right sizing” and years of hard work to achieve sustainable profits and growth, but public markets might not be the “best” venue (for insiders) to achieve this. Restructuring is going to happen regardless, but the incentive to execute this mandate via “go private” transaction tends to be orders of magnitude more pleasant for insiders than “staying the course” as a public company.

This unfortunate situation (for long-term public investors) can lead to insiders selling the company at market “lows” and re-IPO the company at market “highs” post restructuring, thus privatizing “compounding” to PE.

Equity Comp Freak Show

Coupa is (arguably) a case study of this “go private” dynamic and how the “oddities” of equity compensation can work against long-term shareholders:

On July 28, 2022, Coupa Software (ticker: COUP) granted CEO Rob Bernshteyn 390,000 RSUs and 585,000 PSUs (collectively called “Special Award”) with a grant date value of ~$63.7 million, and meaningful service and performance requirements over the next 3 to 5 years to fully vest.

This is a front-loaded equity grant and in lieu of any future equity awards to CEO for the next five years, until fiscal 2028.

While the company says the Special Award is “designed to incentivize Mr. Bernshteyn to drive the Company’s strategic growth and long-term value creation and ensure retention and leadership continuity”, it appears a change in control can trigger accelerated vesting opportunities especially if there’s a termination afterwards.

This special equity award is supposed to keep the CEO engaged and focused on long-term public company value creation over the next 5 years, but, in actuality, has given the CEO material incentive the sell the company to “de-risk” to grant.

Anecdotally, this is also the kind of equity grant that can tip an on-the-fence CEO into running a sales process, especially if the CEO and company have already received in-bound inquiries from prospective buyers.

To be fair, there are “safeguards” in place to prevent accelerated vesting on the 585,000 PSUs via “takeunder”, but vesting 390,000 RSUs on a change in control termination is a nice financial windfall despite losing the unearned PSUs:

If Mr. Bernshteyn’s employment is terminated without cause or due to good reason, in either case, within three months prior to or 12 months following a change in control, the RSUs will accelerate vesting in full in accordance with Mr. Bernshteyn’s amended and restated severance and change of control agreement with the Company.

Also, it’s subtle, but there’s an interesting nuance to the treatment of unearned PSUs following a change in control:

Any PSUs that are earned in connection with a change in control, and any outstanding PSUs earned prior to the change in control, will vest in connection with the change in control (to the extent not previously vested), and any unearned PSUs will be forfeited, unless continued, assumed or substituted in connection with certain changes in control.

An acquirer willing to substitute 585,000 PSUs so the CEO doesn’t forfeit unearned shares following a change in control is a massive strategic alternatives carrot. It will inform any negotiation.

Now, the company disclosed the PSUs will be canceled if the Thoma Bravo deal is approved, but it will certainly inform any retention package for the CEO to stay on post close:

The Company PSUs granted to the Company’s Chief Executive Officer on July 28, 2022 will be canceled for no consideration in accordance with their terms.

Overall, this “Special Award” gives the CEO a $31.6 million financial windfall by selling the company, and requires giving the CEO a lucrative equity package to incentivize him to stick around and operate the company. This package will likely need to match or exceed the value of “canceled” shares.

Acrobatic Activists

If you’re a long-term investor who believes in Coupa’s trajectory, incentivizing “strategic alternatives” is the opposite of what you want to see (i.e. staying the course long-term and executing as a public company), because you’ll lose out on the compounding that is now captured by the acquirer.

Few things are as frustrating as doing the work to identify a high-quality asset, see management sell-out at the bottom (rolling over their equity in the process), privatizing compounded returns for themselves, and re-listing as a public company at market top.

So it shouldn’t be a complete surprise activist HMI Capital sent a letter to the Board expressing their concerns of a “takeunder” following reports Vista was exploring a deal:

A top shareholder in Coupa Software Inc. said the software company should fetch at least $95 a share in a sale after getting interest from at least one potential buyer.

HMI Capital Management said in a letter to the company’s board on Monday that Coupa is an excellent business with a great management team. HMI Capital, which owns a 4.8% stake in Coupa, said it wouldn’t support any transaction unless it was at the right price and followed a proper sales process. (Bloomberg)

The challenge, of course, is following the Thoma Bravo announcement this activist campaign must navigate a situation where the stock is trading for a takeout. The activist must now do price-defying acrobatics to try and get a higher bid or risk the stock crashing back to “stay public” reality. It’s a high wire act.

Clown Show Stewardship

In closing, we can’t call it a governance circus without a clown show.

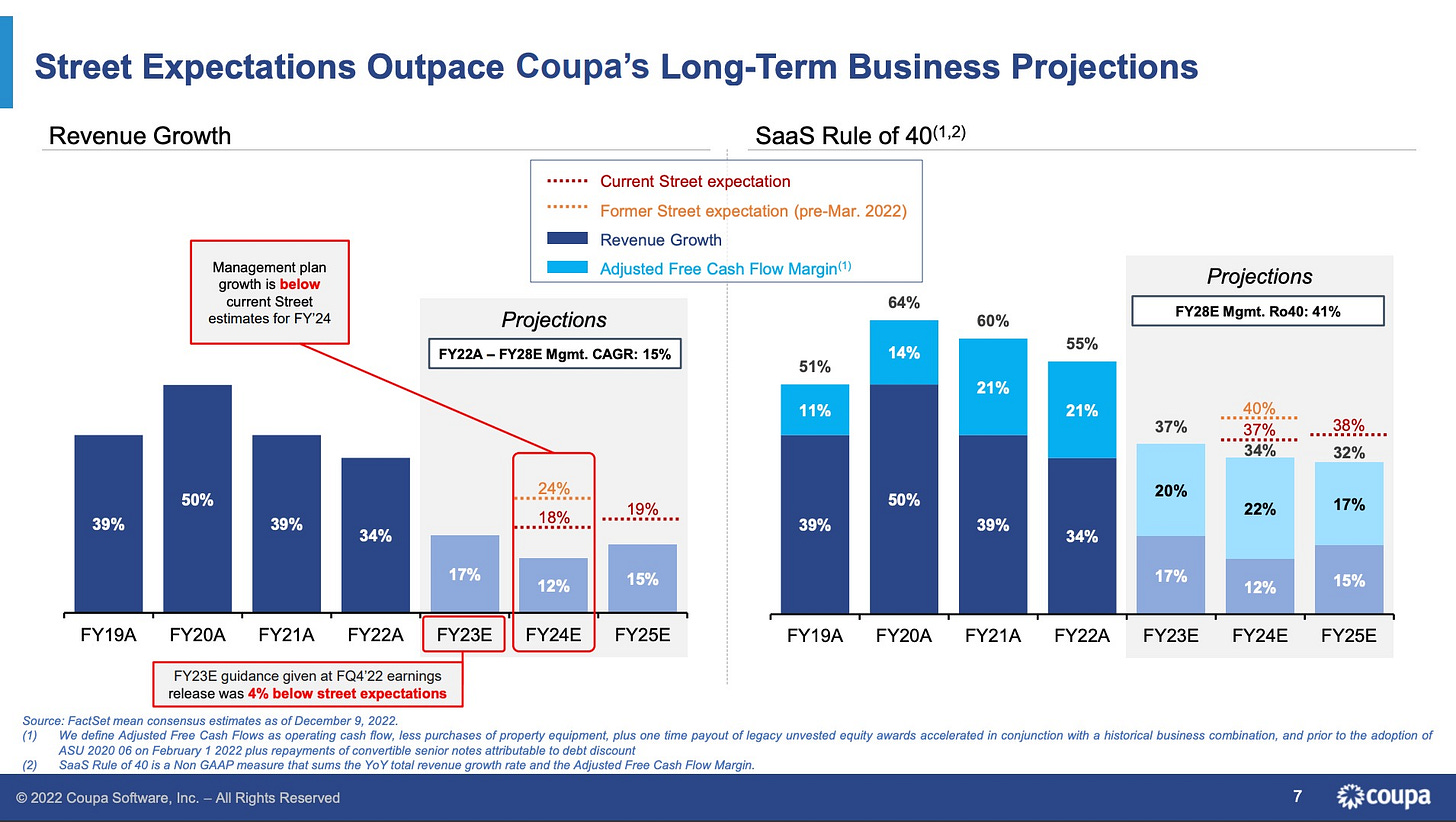

I personally find it humorous Coupa’s Board went from giving the CEO a “special award” (that, in theory, was based on a well vetted and risk-adjusted multi-year operating plan) to execute a multi-year plan to telling shareholders a few months later the multi-year fundamentals have meaningfully deteriorated and they should “capitulate via takeout”:

Apparently, Thoma Bravo is doing shareholders a favor by charitably acquiring the company at $81 per share.

This could indeed be the case or they’re treating public shareholders like “suckers”.

Seriously, though, what happened?

The change in messaging is so abrupt and jarring it leaves investors in a situation where they either 1) accept Thoma Bravo’s offer or 2) the stewardship and forecasting has been so bad that wholesale changes arguably need to happen at the Board and management level to remain a public company.

Either way, grab your popcorn and enjoy the corporate governance circus; it’s the greatest takeout show on Earth.