Crikey! Look at this Instructure Deal

Observing the Contested Thoma Bravo Acquisition Vote

Welcome to the Nongaap Newsletter! I’m Mike, an ex-activist investor, who writes about tech, corporate governance, the power & friction of incentives, strategy, board dynamics, and the occasional activist fight.

If you’re reading this but haven’t subscribed, I hope you consider joining me on this journey.

Since the last newsletter was a case study from 10 years ago, I figure we mix it up and look at a “current” situation.

It’s not often you get to observe a contested M&A deal with questionable corporate governance, but that’s what we currently have going on at Instructure and it’s playing out in real-time.

Insiders are pot committed on pushing through a ~$2 billion ($47.60 per share) go-private acquisition by Thoma Bravo, and several large shareholders (including thoughtful non-activists) are publicly denouncing the deal and intend to vote against the acquisition at the February 13, 2020 Special Meeting. The next couple of weeks should be interesting as the two sides “fight” over the narrative and votes.

Like Steve Irwin quietly observing a beautiful crocodile in its natural habitat, let’s try not to disturb the participants of this contest as we discuss this (beautifully) peculiar deal. Crikey!

On the other hand, if you disagree with the Company’s conduct, feel free to go full Mamba Mentality (RIP Kobe) and dunk on Instructure’s Board and management.

For those following my “Dark Arts” Corporate Governance series (Part 1, Part 2), we’ll definitely be discussing a “dark” action that occurred here and likely distorted the sales process.

Learning Management System (LMS)

The primary focus of this post is on the contested special meeting, but it’s worth spending some time understanding what Instructure does and how the Company ended up in the predicament they are currently in.

If you want a deep dive analysis and valuation of the Company, let me know and I’ll try to put something together for a future newsletter. I actually made a (personal) investment deck last year for Instructure so it’s just a matter of repurposing it for the newsletter.

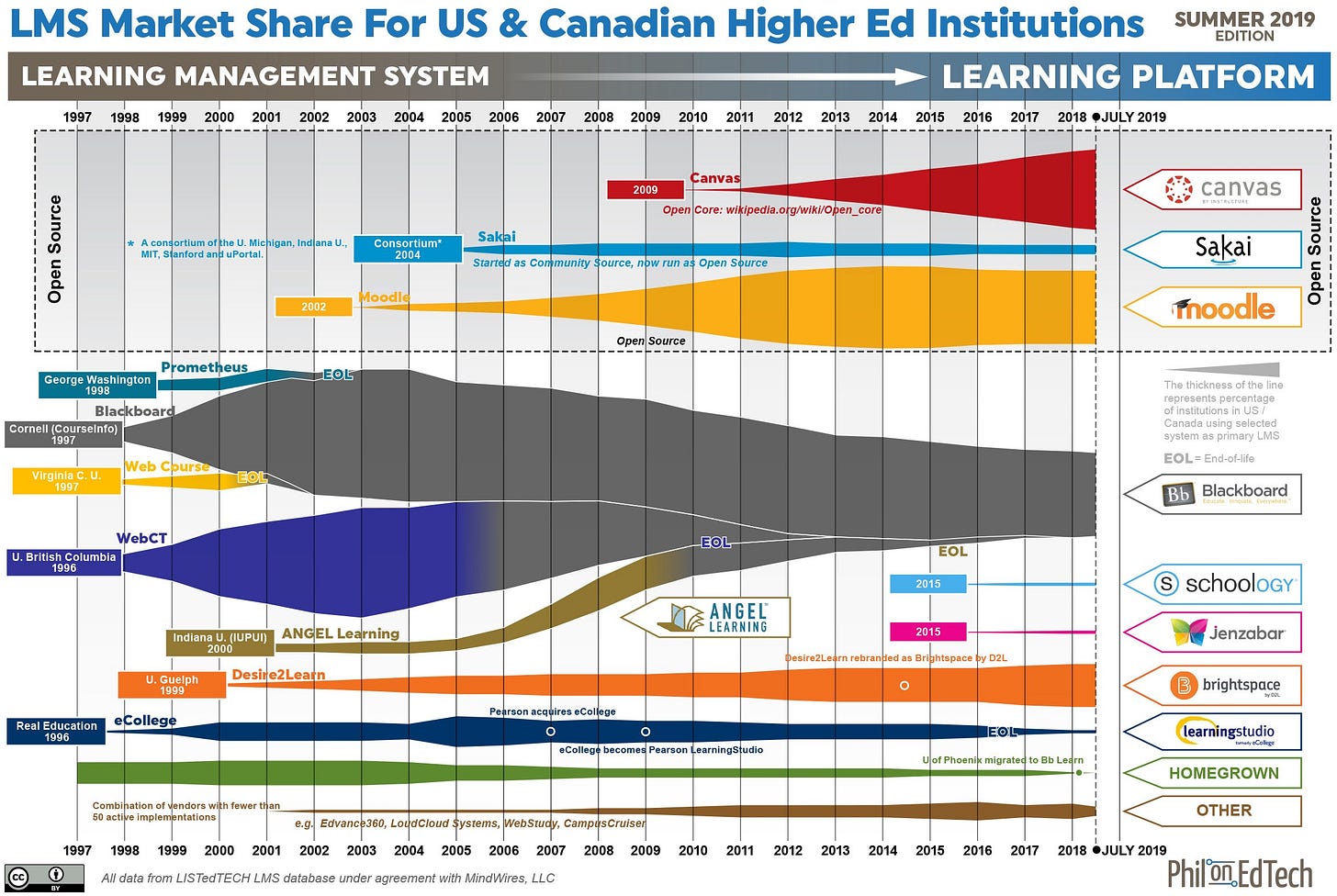

Instructure is a Learning Management System (LMS) cloud SaaS provider who sells into the academic and corporate markets.

For those unfamiliar with LMS software, Wikipedia describes it as:

A learning management system is a software application for the administration, documentation, tracking, reporting, and delivery of educational courses, training programs, or learning and development programs. The learning management system concept emerged directly from e-Learning.

LMS is basically software that helps manage online learning, instructor-led courses, virtual courses, etc.

If you’re a student or employee, you use LMS to access courses, course information, and learning materials. If you’re a teacher or employer, you use LMS to upload courses, manage enrollment, track activity, etc.

Instructure: “Good” Academic vs. “Speculative” Corporate

Instructure sells their cloud LMS into the academic market via its Canvas LMS product and into the corporate market via its Bridge LMS product.

Canvas is considered a very good business: Since its launch in February 2011, Instructure’s cloud-based Canvas product has taken the academic LMS market by storm taking chunks of market share from on-premise incumbent Blackboard with 60% to 80% RFP win rates. Canvas (in my opinion) has a valuable customer footprint and platform/ecosystem with very good unit economics and customer acquisition costs (CAC). Canvas represents a Pareto share of Instructure’s revenue (est. ~$230M out of $259m total revenue) and all of its profitability.

Bridge is considered a speculative bet: Despite Canvas’ compelling unit economics and efficient CAC, Instructure has seen no meaningful operating leverage due to redeploying capital to enter the corporate LMS market with the launch of Bridge (Feb 2015). Bridge continues to be a “VC” type bet in hopes of materially expanding Instructure’s TAM. Shareholder Praesidium Investment Management estimates Bridge only generated $25 million in revenue in 2019 while sustaining over $70 million in adjusted free cash flow losses. In my opinion, it may take another 2 years to really see if the Bridge “bet” works and be a material value contributor to Instructure.

“Activist If You Do, Activist If You Don’t”

At a high-level, Instructure’s strategy effectively put the Company in an “activist if you do, activist if you don’t” situation. It’s one of the contributing factors that drove me to acquire some shares during the December 2018 market sell-off. (Disclaimer: I’m no longer invested in Instructure.)

Those who have read my past newsletters know my pet theory that sell-offs tend to create focus, and will also tip management teams toward entertaining strategic alternative transactions. Given the MindBody acquisition in December 2018, Instructure was a popular “next takeout” name floated around by sell-side.

If Bridge is successful, a strong argument could be made to separate Bridge and Canvas given how different the organizational and capital needs are for the two businesses. If Bridge is not successful and the stock struggles, there would be a lot of pressure from investors to cut costs, focus on Canvas, and drive cash flow.

Instructure’s 2019 (generally) played out as I expected with several activists circling the Company throughout the year and a subsequent public announcement of Strategic Alternatives on November 14, 2019 and Thoma Bravo acquisition announcement on December 4, 2019.

Although Instructure “officially” announced strategic alternatives on November 14, 2019, they informally put up a for sale sign on January 25, 2019.

Corporate Governance “Dark Arts”

Always pay attention to changes in compensation. As previously discussed in the the “Dark Arts” series:

Changes in compensation and grant timing are “tells” (to borrow a poker term) so it’s important to understand the “why” behind those changes. Usually the changes means nothing, but occasionally it hints to something very material.

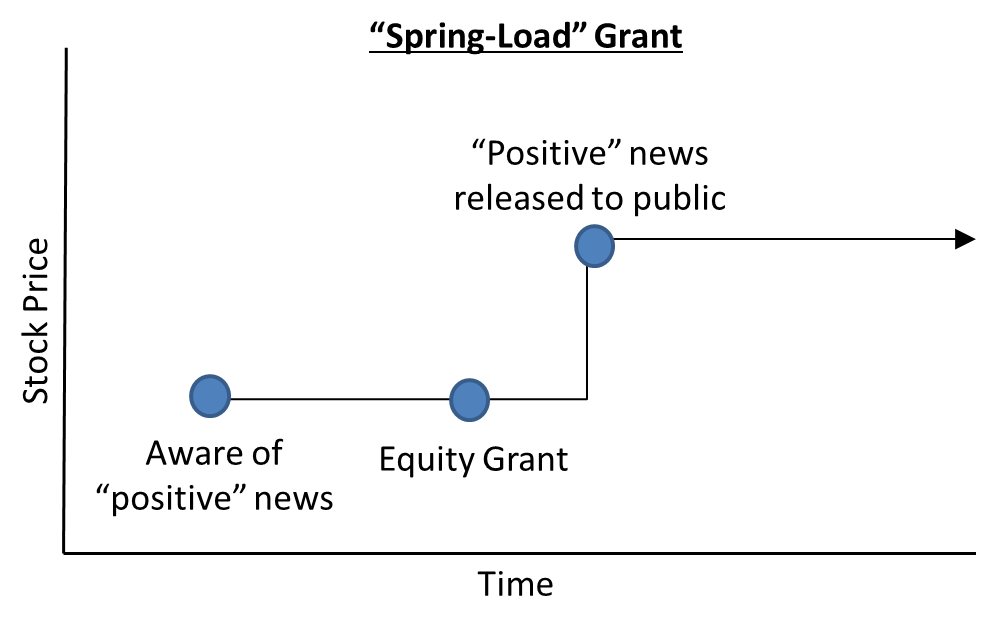

If you can correctly read the motives of the comp committee (chair) and recognize a material “spring load” or “bullet dodge” is happening, you can trade alongside management’s greed and profit.

So what happened on January 25, 2019 that hinted the Company unofficially put themselves up for sale?

The Company filed an 8-K disclosing they made major, equity-heavy changes to their compensation program:

Company paid 2018 annual performance bonuses in the form of restricted stock units (RSUs) instead of cash, setting the value of the RSUs at 125% of the amount of cash bonus earned.

The Compensation Committee discontinued its compensation practice of establishing an annual cash bonus program and granting annual equity grants. As a result, Instructure does not expect to pay annual cash bonuses or make annual refresh equity grants to its executive officers for fiscal years 2019 through 2022. In its place, the Compensation Committee granted a multi-year RSU grant that vests quarterly over four years.

The Compensation Committee also allowed all Instructure employees the option to receive an RSU in lieu of 20% of their base salary.

Why would they do this?

It’s fair to assume the insiders thought the stock was “cheap”, but these changes were extraordinary (in my opinion) and went above and beyond insiders simply wanting more equity exposure. This was a massive up-front grant.

I didn’t exactly know what was going on at the time, but all signs pointed to something was going on here and I should probably be long. (I was long.)

Luckily, we don’t have to wonder what drove the changes, and can review the Background of the Merger to see what activity occurred in January 2019:

On January 8, 2019, a financial sponsor (“Sponsor A”) requested a meeting with Joshua Coates, the Executive Chairman of Instructure. In response to Sponsor A’s inbound inquiry, Mr. Coates had a call with Sponsor A that same day during which Sponsor A expressed an interest in acquiring Instructure for $53.00 to $55.00 per share. On the same day, the Board of Directors held a meeting to discuss Sponsor A’s expression of interest.

On January 9, 2019, Sponsor A sent Mr. Coates a preliminary, non-binding, written proposal to acquire Instructure for $53.00 to $55.00 per share, assuming a fully diluted share count of approximately 37.67 million shares of Instructure common stock. Later that day, Mr. Coates shared such proposal with the Board of Directors.

On January 21, 2019, Sponsor A visited Instructure’s headquarters and met with members of Instructure senior management to discuss Instructure’s business model and strategy, and Instructure provided Sponsor A with preliminary due diligence information about its business. On that same day, at the direction of the Board of Directors, members of Instructure senior management met with J.P. Morgan to discuss the proposal by Sponsor A.

On January 22, 2019, the Board of Directors held a telephonic meeting with members of Instructure senior management, representatives of J.P. Morgan and representatives of Cooley LLP. Representatives of Cooley advised the Board of Directors and members of Instructure senior management with respect to fiduciary duties attendant to addressing inbound inquiries and any strategic transaction process, should such activity materialize. The Board of Directors then discussed the utilization of a strategic transaction committee (the “Advisory Committee”), in order to ensure that the Board of Directors’ could appropriately evaluate, oversee and manage a strategic transaction process if one resulted specifically from the interest of Sponsor A. At the conclusion of this discussion, the Board of Directors established the Advisory Committee and designated Mr. Coates and William M. Conroy as members of the Advisory Committee due to their experience with strategic transactions, existing roles on the Board of Directors, and willingness to serve on the Advisory Committee.

HOLY GUACAMOLE BATMAN!

The Board approved the new front-end loaded multi-year equity grants on January 23, 2019 when the stock was at $39.30 with full knowledge that a $53.00 to $55.00 per share offer was on the table.

That’s a massive “spring load” equity grant and it’s not even subtle. For those not familiar with “spring loading”, it’s when the company grants equity and then releases news that positively impacts the stock price.

In the case of Instructure, the Board was fully aware a material (preliminary) takeout offer was on the table when they granted equity to management in January 2019. A deal was not consummated, but it essentially distorted and corrupted insider incentives from that point forward to go-private.

How did it distort incentives? There’s a lot of incentive to trigger accelerated vesting with change of control. Why wait 4 years to vest all that equity when an acquisition triggers a change of control accelerated vest? It also, gives CEO Dan Goldsmith some leverage when negotiating with prospective buyers.

Compensation Committee Chair William Conroy (yes, the same William Conroy that was placed on the Strategic Transaction Advisory Committee) has some explaining to do.

Erosion of Trust

As a general rule, once a Board commits an egregious “dark” action (i.e. “spring loading” equity) it’s next to impossible to trust them going forward.

In the case of Instructure, how can public shareholders trust the Board and management to objectively evaluate go-private offers vs. staying public when the Board gives management a “spring loaded” multi-year equity grant with full knowledge there was a $53.00 to $55.00 per share preliminary offer on the table?

You can’t trust them.

Given the blatant “spring load” grant, it’s very difficult to give the Company the benefit of the doubt on any of their decisions in this sales process or what they have to say to defend the deal.

For instance, it’s (in my opinion) highly unusual Board member Kevin Thompson was so involved in the M&A process given:

He’s the CEO of another public company (SolarWinds). This is a distracting and time consuming process to be a major participant in.

Thoma Bravo is a major shareholder of SolarWinds with several Board seats.

Thoma Bravo is on SolarWinds’ Compensation Committee.

He should have recused himself, but instead got MORE INVOLVED with special committee assignments after Thoma Bravo reached out to Instructure CEO Dan Goldsmith in June 2019.

The Board also gave CEO Dan Goldsmith a lot of responsibility in driving the sales process throughout the year despite his objectivity clearly distorted by the “spring loaded” equity grants.

Finally, there’s a lot of scrutiny over whether any of the insiders will rollover their equity into the Thoma Bravo deal, especially executive Chairman and founder Joshua Coates. The Company says there are no current plans in place to rollover equity, but I have a hard time believing he won’t roll some or all of his 6% interest into the Thoma Bravo deal.

Frankly, given the nature of the LMS market and the close-knit academic community, it would be moronic of shareholders to assume Thoma Bravo would not want Joshua Coates involved in some capacity.

The worst part is the Company is so committed to pushing through a transaction that they’re now alienating non-activist stakeholders and using scare tactics no one believes.

Prior to the acquisition news, the Company was consistently defending the long-term growth prospects of Canvas:

Now I would like to share details on how key areas of our business are performing. Domestic Canvas is progressing nicely, on track to deliver results in line with our outlook for the year. So while some analysts have been reporting a sharp slowdown in Higher ED LMS switches we are not seeing that trend in our domestic Canvas bookings. In fact our high ED domestic bookings are on track to be up this year over last year.

But with an acquisition on the table, that tone has reversed course:

There is significant ongoing risk to Instructure’s core business and its long term prospects, and the price offered by Thoma Bravo exceeds what our Board, in consultation with its financial advisors, believes can be achieved on a stand-alone basis at this time.

If this risk was remotely true, an investor as sophisticated as Thoma Bravo would not be taking on leverage to acquire Instructure. Instructure of all companies knows the risk of a bad private equity deal given they capitalized on Blackboard’s missteps as a PE held Company.

Dispute with Shareholders

Given the circumstances, it’s totally understandable why large thoughtful (including non-activist) shareholders don’t like the deal and why proxy voting advisory firm ISS is against the deal as well.

Incidentally, when I did my valuation of Instructure in February 2019, I estimated a stand-alone value of $47.62 (core assumptions redacted). Yes, this is me taking a victory lap on nailing Thoma Bravo’s $47.60 per share takeout price.

Anyway, based on the work I’ve done, this deal does feels like a “take under” and given management’s incentives are so distorted towards doing a deal I question the objectivity and honesty of the entire process.

If $47.60 per share was truly the best offer the Company could achieve, there should have been a more concerted effort at the Board level to develop a “stay public” plan vs. going “all in” in this Thoma Bravo deal.

What’s Next?

The vote occurs February 13, 2020 and a lot can happen in the next two weeks.

Regardless of the outcome of the vote, I believe the Board and management have done irreparable harm to corporate governance and destroyed the trust of shareholders.

It’s difficult to know what happens next if shareholders reject the deal, but a strong argument can be made that meaningful changes need to happen at the Board and management level given the breakdown in governance and “spring loading” issues.

If shareholders do accept the Thoma Bravo offer, there could still be a fight in the courts.

Crikey! Stay tuned.