GOGO Strategic Alternatives

Show me the desired outcome and I'll show you the restructured comp plan

Welcome to the Nongaap Newsletter! I’m Mike, an ex-activist investor, who writes about tech, corporate governance, the power & friction of incentives, strategy, board dynamics, and the occasional activist fight.

If you’re reading this but haven’t subscribed, I hope you consider joining me on this journey.

How do insiders “signal” they’re seriously considering strategic alternatives?

It’s a question I ask myself all the time.

The answer is generally straightforward to figure out ex-post, especially when you have access to M&A filings and background on merger disclosures, but it’s tricky ex-ante.

Even when a company publicly announces the need for strategic alternatives, predicting the timing is hard. A long list of macro (i.e. COVID-19) and micro (i.e. executive egos) factors come into play that can and will influence the outcome considerably.

That said, it’s a fun puzzle to work on (and profitable if you can nail the timing).

For this write-up, I wanted to walk through some of the strategic alternatives “signals” left by in-flight WiFi provider Gogo Inc. (ticker: GOGO) leading up to the announced sale of their Commercial Aviation business to Intelsat for $400 million.

Hopefully some of the concepts and takeaways I highlight will help you identify (ex-ante) the next crop of companies contemplating strategic alternatives.

Note: Strategic alternatives can feel like it happens on command (“Go go gadget strategic alternatives!”), but more often than not it takes years of waiting for the right situation and a surprising amount of coordinated planning before a process finally triggers. The key is to recognize when that “coordinated planning” is occurring and escalating.

Gogo Inc.

For those unfamiliar with GOGO, they’re an in-flight Internet company that offers broadband connectivity and wireless entertainment services to commercial and business aircraft.

To achieve this, the company operates dedicated satellite and air-to-ground (“ATG”) networks, and installs and maintains in-flight systems of hardware and software on aircraft. GOGO’s equipment is installed in ~3,200 commercial aircraft and ~5,700 business aircraft (as of December 31, 2019).

GOGO operates two businesses: Business Aviation and Commercial Aviation

Business Aviation (i.e. selling Internet connectivity to private jets) is considered the much better business while Commercial Aviation (i.e. selling Internet connectivity to commercial airlines) is considered structurally challenged with many (including GOGO management) believing the industry is in need of consolidation.

Long Story Short: Be Aware of Personal Biases

Before we dig further, I wanted to point out I had multiple opportunities to write about GOGO before a deal was announced but didn’t. My bad.

The big lesson here is be aware of your biases and how they can cloud your investment judgement. Pre-existing investment biases prevented me from being objective with GOGO.

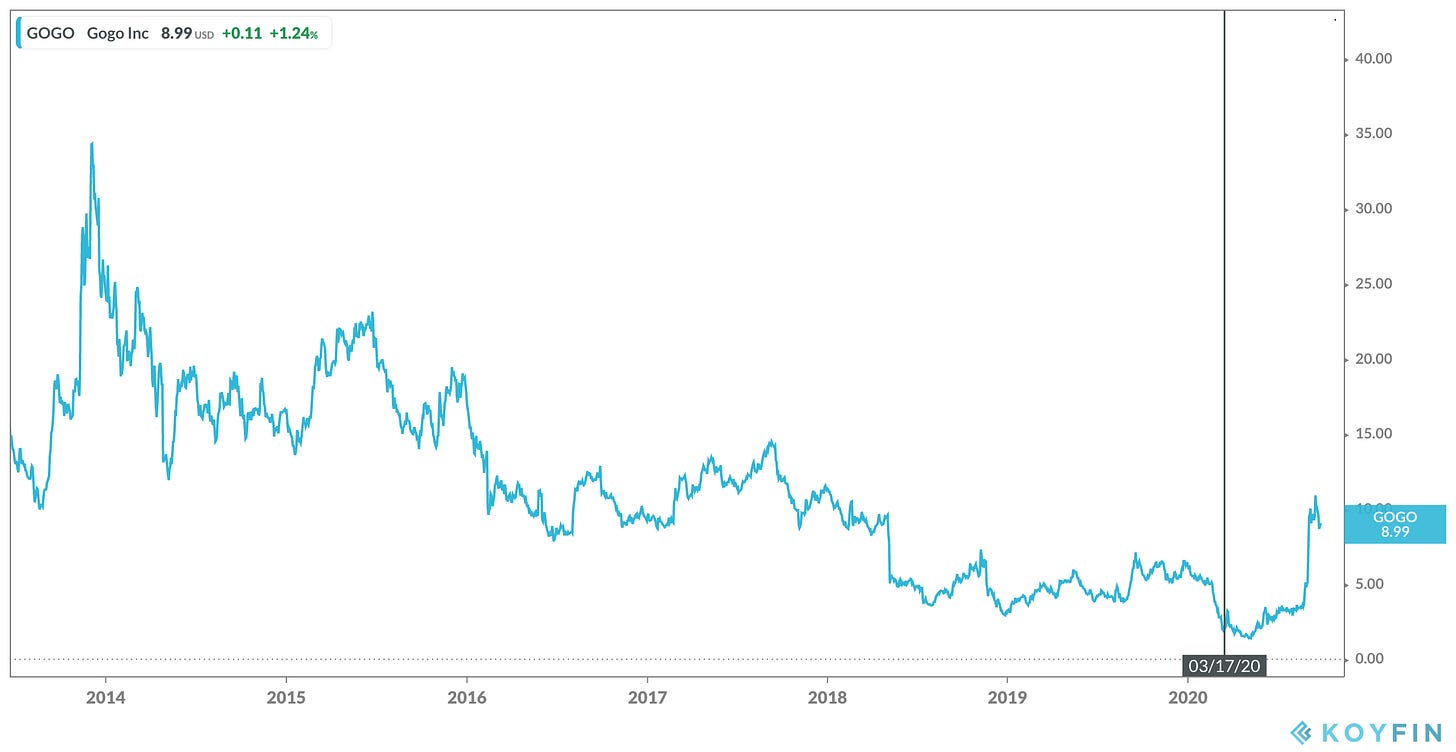

Historically, GOGO was (in my opinion) a very good stock to short due to the structural challenges of the Commercial Aviation business. That short-bias made it very hard for me to objectively consider GOGO as a long under any scenario.

Note: GOGO was historically a decent short, but the first meaningful “long” signal I noticed (and ignored due to my short-bias) was the company disclosing a stock option exchange proposal in their preliminary 2020 proxy mid-March 2020.

I ended up quickly dismissing “long” signals I normally high-grade as thesis changing.

Now to be fair, the first meaningful “long” signal I saw (i.e. stock option exchange proposal) was in March 2020 when COVID-19 was roiling markets and GOGO’s debt was entering distressed territory. Even if you believed industry consolidation was finally going to happen, being long GOGO equity in March 2020 was incredibly speculative and risky.

Nevertheless, if I was more objective, I’d recognize the situation at GOGO was evolving and subsequent compensation adjustments and equity grants in the summer were sending strong signals to “go long”.

Lesson learned.

Years of Consolidation Speculation

Consolidation within the in-flight connectivity (IFC) industry has been a recurring speculation for years.

Louie DiPalma, an analyst who follows aerospace and defense companies for Chicago-based William Blair, wrote April 30 that the IFC industry “has needed consolidation,” saying the three-year stock returns of Panasonic Avionics’ competitors “have all significantly underperformed broader indices because the commercial airline IFC industry is overcrowded, which has resulted in billions of dollars of cash burn.”

“If IFC industry consolidation were to take place, we believe that consolidation between PAC [Panasonic Avionics], Gogo, and Global Eagle would be the most likely because all three use the same Ku-band satellite technology, which would allow for significant bandwidth synergies. We would not be surprised if a third-party attempted to combine the commercial IFC businesses of all three Ku-band providers,” he wrote. (source, May 2018)

Everyone agrees IFC consolidation needs to happen, but the challenge is timing. What would be the major catalyst to finally make consolidation happen?

Many speculated COVID-19 could finally be that catalyst to drive consolidation, which appears to be the case after GOGO announced on August 31, 2020 they were selling their Commercial Aviation business to Intelsat for $400 million.

While COVID-19 was a key catalyst for consolidation, do not underestimate the impact of equity compensation adjustments at GOGO to facilitate a deal.

After all, incentives drive outcomes.

Incentives Drive Outcomes

How do insiders “signal” (ex-ante) they’re considering strategic alternatives?

There are many “signals” to consider, but they all generally pale in comparison to incentive-based signals. As Charlie Munger famously said:

“Show me the incentive and I'll show you the outcome.”

When it comes to strategic alternatives, I have a slightly remixed version:

“Show me the desired outcome and I'll show you the restructured comp plan.”

If the desired outcome is a transaction, you’ll see Boards restructure compensation plans around transaction centric outcomes. That way, management teams are incentivized to pursue strategic alternatives.

Examples of incentivizing strategic alternatives include:

Implementing equity vesting terms that are transaction friendly (i.e. price-based vesting, single-trigger vest upon change-in-control, etc.)

Changing the mix of compensation towards options and/or equity that disproportionately pays out upon a transaction

Front-loading large equity grants

Granting equity with out-of-the-money price hurdles

Introducing bonuses tied to consummating a transaction

While these tend to be good signals, let me re-emphasize that it’s still hard to reliably predict the timing of a transaction. Even if you incentivize management to pursue strategic alternatives, it doesn’t mean the market will meet your clearing price to get a transaction done. (Please refrain from SPAC jokes)

Put another way, consider adjustments to compensation as “starting a clock” on strategic alternatives, but time can run out.

With all this in mind, let’s examine some compensation adjustments made by GOGO that (in my opinion) signaled the Company was serious about pursuing strategic alternatives.

GOGO’s Stock Option Exchange

First up is GOGO’s stock option exchange plan (which was unusual to me). I’ve gone through a lot of proxy statements over the years, and don’t recall the last time I’ve encountered an option exchange plan like this (maybe financial crisis?). That alone should have been a signal for me to dig deeper.

Basically, an option exchange plan allows insiders to exchange their deep out-of-the-money options for options that have a lower exercise price. The exchange is typically based on a ratio and not 1-for-1. Per the 2020 Proxy:

Employees (including our executive officers) will be given the opportunity to exchange certain stock options owned by them for a lesser number of new stock options based on exchange ratios determined by our Compensation Committee.

As of February 28, 2020, there were 7,613,390 outstanding options held by our employees, of which 99.6% were “underwater” on that date, meaning the exercise price of the option exceeded $3.61, which was the closing trading price of our common stock on that date.

The Option Exchange will be offered only with respect to stock options with an exercise price that is equal to or greater than 150% of the closing price of our common stock on the commencement of the exchange period.

Keep in mind this proposal comes off the heels of COVID-19 obliterating GOGO’s stock price. It felt very opportunistic to introduce this proposal at the time.

Because of this timing and GOGO’s long history of sluggish performance, some understandably did not like the option exchange proposal, and believed it signaled weak corporate governance.

Was it egregious?

The optics weren’t exactly great when you consider insiders have 40% voting power and would essentially be reseting their out-of-the-money options at near all-time-low prices.

Optics aside, the option exchange would set the table for strategic alternatives. By exchanging out-of-the-money options with lower strike options, insiders now have strong economic incentivize to do a deal. Given insiders essentially control the Company with 40% of the vote, the stock option exchange proposal carries a lot of weight in terms of signaling intent to get something done. In my opinion, you don’t commit to a significant option exchange without a plan in mind to drive the stock.

During GOGO’s Q4 2019 earnings call on March 13, 2020, CEO Oakleigh Thorne called out consolidation as being on the table:

I would say everything is kind of on the table because these are dynamic times and industry needs to see the consolidation, and there's a lot of conversations taking place.

Between different players in the ecosystem. Some people looking at more vertical integration plays, some people are looking at more horizontal integration play.

So we do think the CA business does need to see some consolidation. And we think that GOGO by virtue of our market share, by virtue of our really strong distribution, product road map, engineering, systems integration capabilities, etc. is a very important component of the industry, and it would be up a lot of value to somebody who really wants to be a big player in the industry.

So that's how we look at it. I think there's -- I don't want them to leave people in to being that there's anything imminent going on, but there is a lot of conversation taking place.”

So a few days after management talks about consolidation being on the table, the Company discloses their intent to exchange deep out-of-the-money options for lower strike price options. If I didn’t have a pre-existing short bias on GOGO, this is where I should have realized the options exchange is thesis changing signaling.

Anyway, after the proposal was passed and insiders received their new options on June 12, 2020 with a $2.61 strike price, we would later find out via Intelsat disclosures (filed August 24, 2020) that GOGO’s Commercial Aviation sales process would formally begin shortly thereafter.

Management would also acknowledge this formal sales process during their Q2 2020 earnings call on August 10, 2020:

Several parties expressed interest in our CA business in the second quarter. And as a result, we retained BDT & Company as our primary advisers and launched a formal process this summer to evaluate our strategic options for that business. We've been in extensive discussions with multiple parties and feel optimistic that a deal may happen. However, we cannot be sure that we will be able to consummate a transaction.

Put it all together, GOGO was informally engaged with several parties throughout 2020 who expressed interest in their Commercial Aviation business, but did not start the formal sales process until AFTER insiders received their new options.

Based on the sequence of events, an argument could be made the options exchange was implemented to better incentivize a strategic alternatives process.

After all, incentives drive outcomes.

Equity-in-lieu-of-Cash

Another interesting equity transaction that occurred over the summer was a July 15, 2020 equity grant to CEO Oakleigh Thorne:

These shares of common stock were granted to the reporting person in lieu of the after-tax amount ($647,609.76) of the reporting person's 2019 performance year cash bonus of $1,003,991.60.

In order to support actions taken by the Company and its employees to preserve liquidity following the COVID-19 outbreak, Mr. Thorne agreed on March 13, 2020 to defer the payment of his cash bonus (which would otherwise have been paid on March 20, 2020 pursuant to the Company's 2019 bonus plan that was approved by the Compensation Committee on March 29, 2019) to a future date not later than December 31, 2020.

On July 15, 2020, in further support of the Company's cash preservation efforts, Mr. Thorne requested that his bonus be paid in stock rather than cash. The conversion was based on a share price of $3.28, the closing price of the Company's common stock on July 15, 2020, the date on which the Compensation Committee of the Board of Directors approved the grant.

Anytime you see executives requesting their cash bonus be paid in stock, you should place high odds insiders think the stock is really cheap. They’re finding excuses to load up on equity.

While this grant doesn’t signal strategic alternatives activity, I’d generally say (off-cycle) equity grants in July tend to have higher “spring load” potential since insiders know June 2020 quarterly results at the time of grant. If the results were bad, insiders tend to wait until after earnings to get their equity.

On its own, this grant isn’t a screaming signal, but it’s pretty intriguing when combined with the options exchange in June. (Why did I ignore GOGO again? Oh yes, that’s right…investment bias.)

With the power of hindsight, we also now know the grant was indeed a “spring load” and insiders were in possession of material nonpublic information. GOGO was in the middle of a formal sales process when this grant occurred.

Given the timing of the grant, an argument could be made the CEO wanted his grant made ahead of announcing a formal sales process for Commercial Aviation business. Remember, it was his choice to get the grant in July and he could have waited until December 31, 2020.

Transaction Driven Bonus

In addition to equity grants, GOGO also introduced new transaction centric bonuses to management.

Following GOGO’s announcement in August 2020 they were conducting a formal sales process for the Commercial Aviation business, the Board approved new bonuses tied to consummating a transaction:

The CA Bonus program provides our Named Executive Officers and certain other employees with an opportunity to earn an additional award contingent upon the consummation of, and in recognition of the significant work effort involved in, a transaction related to our CA business. Under the CA Bonus program, our Named Executive Officers have an opportunity to earn awards that range, at target value, from 50% to 133% of their Current Target Bonus

I have to hand it to GOGO. They were not bashful about restructuring incentives around driving strategic alternatives. This shouldn’t come as a total surprise since the CEO owns ~30% of the Company and presumably has near unilateral control at the Board level.

What’s interesting is despite all these disclosures and signaling, the stock generally hovered in the $3 range throughout the summer. It only recently pushed into the $10s following the announced $400 million deal with Intelsat and the arrival of a new 14.9% private equity 13D filer which could push the company to further strategic alternatives actions.

I suppose I wasn’t the only one with pre-existing bias clouding my judgement.

Strategic Alternatives 2021?

Overall, GOGO is a great example of a company implementing changes to incentives ahead of pursuing strategic alternatives in earnest.

I personally believe 2021 could be a busy year for strategic alternatives across multiple industries so definitely pay attention to changes in compensation and incentives next year.

After all, incentives drive outcomes.