Nubank: Marrying Strategy, Opportunity, and Culture

Something Old, Something Nu, Something Borrowed, Something Blue...

Hello free subscriber. It’s been a while. You might not remember why you subscribed to this newsletter so let me re-introduce myself…

Welcome to the Nongaap Newsletter! I’m Mike, an ex-activist investor, who writes about tech, corporate governance, the power & friction of incentives, strategy, board dynamics, and the occasional activist fight.

If you’re reading this but haven’t subscribed, I hope you consider joining me on this journey.

How is it November already?! Anyway, I wanted to mix things up and do a free non-governance write-up.

This piece features Brazilian fintech Nubank, who recently filed to go public, and will certainly be a closely followed name for years to come.

Going public can often feel like a "marriage” between the company and public markets so I thought it be fun to (apply a completely made-up marriage-themed investment framework to) assess the company.

Let’s dive in!

Nu Amor

It’s not hard to love what Brazilian fintech Nubank is accomplishing from afar.

Their marriage of strategy, opportunity, and culture has created one of the most valuable companies on the planet, and they’re arguably just getting started.

With Nubank recently filing their F-1 statement to go public, I wanted to revisit their story, highlight interesting (to me) disclosures in their filing, and contemplate what lies ahead.

The company and valuation is deservedly in a honeymoon stage right now, but plenty of work lies ahead to build an enduring relationship with customers, markets, and investors alike.

Mi Amor! Nu Amor!

Note: Incidentally, Nubank did a loved-themed marketing campaign called NuAmor.

Marriage of Strategy, Opportunity, and Culture

Nubank’s ability to pursue underbanked and unbanked customers in Brazil with tech-enabled solutions, customer-first strategies, and an ownership-minded culture has unlocked a massive market opportunity for them.

Simply put, the company has done an incredible job marrying strategy, opportunity, and culture.

Speaking of marriage, there’s a well-known saying that a bride should wear “something old, something new, something borrowed, something blue, and a sixpence in your shoe” on their wedding day.

And when I study Nubank’s story, an argument could be made that founder David Vélez brought “something old, something new, something borrowed, something blue, and a sixpence in your shoe” to successfully launch and scale Nubank.

Yes, I’m about to turn a marriage rhyme into an investment framework.

Specifically, when assessing a company, you should examine:

Something Old: Company and/or management’s history and track record

Something New: Differentiated innovations and key new initiatives

Something Borrowed: Proven playbooks being deployed

Something Blue: The company culture, leadership, and its evolution

Sixpence in Your Shoe: Alignment of incentives to long-term value creation

In my experience, companies and management teams that grade well across all these factors are (potentially) compelling long-term investments.

Something Old

Traditionally, something old is a family keepsake carried or worn by the bride. This symbolizes continuing her past life in her future marriage.

It’s hard to understand someone’s “present” story without trying to understand their “past” stories. Finding the continuity between the past and present can be the key to understanding what the future may hold.

This is why I think it’s important to understand the history and track record of companies and management teams alike. It’s not only important to understand what was accomplished in the past, but how and why it was accomplished the way it was.

When you examine founder David Vélez’ background and what he professionally accomplished before starting Nubank, it’s very polished:

Investment banking at Morgan Stanley

Private equity at General Atlantic

Venture capital at Sequoia

Undergraduate and MBA at Stanford

While this is a very impressive background, it doesn’t fully capture how and why Nubank and his stewardship of the company has been so special.

You could even argue his background would typically lend (no pun intended) itself to rigid conventional thinking that would be detrimental to starting and scaling a company like Nubank.

And yet, rigidity in thinking (not to be confused with conviction) doesn’t appear to be a major issue at Nubank and with this management team.

Interestingly, when you read David Vélez’ Seven Questions interview with Sequoia, he mentions how being less rigid and more flexible about empowering his people to execute was an important moment for him:

Question: When did you realize you were wrong about something?

“In the first few months of Nubank, I asked everybody to be here by 8:00 a.m. every day. I saw it as a test of people’s commitment, and I was pretty rigid about it.

But it was tough on the team. People have different schedules, and some of them were commuting more than two hours. One of my co-founders eventually came to me and encouraged me to rethink the policy. I realized I’d been hiring all these great people and then basically not trusting them from day one.” (source)

Flexibility and adaptability are (in my opinion) mission critical traits of enduring organizations and great leaders so it’s really important to find any history or track record of demonstrated flexibility and adaptability.

David Vélez’ comment on adjusting employee hours is subtle, but it’s the kind of mindset shift I’m looking for when examining “something old”. It’s more philosophical than tangible in nature, but don’t underestimate the compounding impact these mindset shifts can have on an organization long-term.

Something Nu

The bride wearing something new on her wedding day represents a hopeful future.

Nubank has introduced so many great, new innovations to Brazil’s banking sector that I went ahead and rebranded “something new” to “something Nu”.

Nubank’s technology know-how, differentiated underwriting, and customer-first approach has created a structural operating advantage to take on well-capitalized incumbent banks, sustainably acquire unbanked and underbanked customers, and gain meaningful market share in Brazil (and potentially beyond):

Our all-digital, cloud-based platform is low cost, highly efficient and scalable. As a result, we estimate that our cost to serve and general and administrative expense per active customer is approximately 85% lower than those of incumbent financial institutions in Brazil, based on their publicly available financial statements. (source)

We acquired approximately 80%-90% of our customers organically on average per year since our inception, either through word-of-mouth or a direct unpaid referral from an existing customer without incurring direct marketing expenses. (source)

Needless to say, innovation is front-and-center at Nubank, but what I find most impressive is the company’s willingness and ability to embrace potentially disruptive risks, like PIX, and turn them into new opportunities.

For those not familiar with PIX, the Central Bank of Brazil launched the instant payment system (PIX) in 2020 that allows real-time payments and transfers. The new payment system has taken Brazil by storm:

Pix, a system which allows fast money transfers over smartphones, has become ubiquitous in the 11 months since it was launched by Brazil’s central bank. (Bloomberg)

One year ago the Pix platform didn’t exist. Now half the population uses it, showing just how quickly adoption of digital payments can spread. (Bloomberg)

PIX could have been potentially very disruptive for Nubank, but they have been aggressively pushing PIX to their own customer base and reportedly have a fifth of all keys registered on PIX. So far, PIX has probably served as a source of customer acquisition for them.

This ability to be adaptive and flexible with their innovation and seamlessly embrace a paradigm shift like PIX makes Nubank very unique.

Something Borrowed

This is typically something borrowed from another bride. It is thought that this borrowed item will transfer luck from one marriage to another.

The playbooks being “borrowed” by Nubank aren’t unique or earth shattering, but are extremely effective:

Take advantage of incumbent banks stuck in an innovator’s dilemma

Build tech-enabled products to create a structural cost advantage and differentiated underwriting know-how to unlock a historically neglected customer demographic

Prioritize customer centricity in your organization (focus on NPS) to drive lowers customer acquisition costs and churn

Create a virtuous cycle (flywheel) by passing on lowers rates, offering better services, etc. to scale and widen your moat

While these things are fairly “obvious”, it’s all about execution and Nubank has demonstrated an ability to really execute on proven playbooks.

Something Blue

Purity, fidelity and love are all represented in the something blue worn by the bride.

If “something borrowed” tells us the what (i.e. playbook), then “something blue” tells us the why and how (i.e. execution).

For me, “something blue” is the company’s culture, leadership, and the capacity to evolve. It’s the “essence” of an organization that will help it achieve long-term success and overcome challenges.

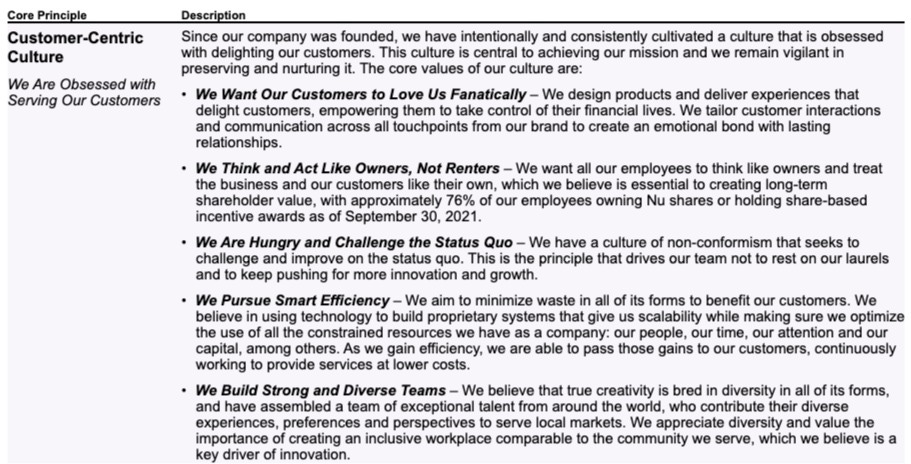

Reviewing Nubank’s F-1 filing, I really appreciate how much emphasis they put into highlighting culture and actually lead with culture when discussing their 4 core principles:

Of course, there are trade-offs.

Nubank’s high-growth, ownership culture requires giving their employees a long runway of opportunity (professionally and financially), and those opportunities can quickly change, especially when the company goes public. That’s not necessarily a bad thing, but highlights how the culture will need to continuously evolve to achieve long-term goals.

A key factor to monitor going forward is how founder David Vélez continues to improve and level-up the culture at Nubank after the company goes public.

And a Sixpence in Your Shoe

Placing a sixpence (or penny) in her shoe symbolizes a life of wealth and prosperity.

Alignment of incentives matters a lot to me, and I appreciate Nubank explicitly calling out its equity compensation to employees to reinforce an ownership-minded culture:

We Think and Act Like Owners, Not Renters – We want all our employees to think like owners and treat the business and our customers like their own, which we believe is essential to creating long-term shareholder value, with approximately 76% of our employees owning Nu shares or holding share-based incentive awards as of September 30, 2021. (source)

Keep in mind that Nubank is based in Brazil where giving employees equity isn’t widely practiced so this is a pretty big deal (in my opinion).

Given the meteoric rise in valuation, this is an area to keep an eye on.

Embrace the Honeymoon, Acknowledge the Work Ahead

Overall, the company and valuation is currently in a honeymoon stage, but there will certainly be (expected) bumps in the road ahead as the company goes public. Like any marriage, it’s important to acknowledge there’s plenty of work ahead to build something lasting.

But as long as Nubank stays true to “something old, something new, something borrowed, something blue, and a sixpence in your shoe”, their public company journey should be a long and fruitful one.