"Spilling the Tea" on e.l.f. Cosmetics

How a Series of Governance Lapses (Likely) put ELF Into Play

Welcome to the Nongaap Newsletter! I’m Mike, an ex-activist investor, who writes about tech, corporate governance, the power & friction of incentives, strategy, board dynamics, and the occasional activist fight.

If you’re reading this but haven’t subscribed, I hope you consider joining me on this journey.

The intent of this writeup is to point out an interesting governance and activist situation at e.l.f. Cosmetics (ticker: ELF), run an “activist game theory” exercise, and speculate on potential outcomes. I own shares, but this post is not an investment recommendation. Please do your own research.

TLDR Summary

ELF is one of the most interesting activist situations I’ve come across in a while. It has everything:

Great core business model with bloated cost base. (With potentially meaningful runway to cut costs.)

A small cap (~$800M) management team paying themselves like they’re running a $16B company (Ulta).

Poor stock performance since going public (September 2016), non-existent capital allocation, and disgruntled shareholder base (2/3 of public investors did not support CEO Tarang Amin and Lead Director Beth Pritchard at an uncontested 2019 Annual Meeting).

A Board more concerned with distorting their corporate governance lapses (confusing shareholders) instead of transparently fixing them. Directors will be exposed to scrutiny from shareholders and Proxy Advisory firms in a potential contested election.

North Korea violations and exposure to tariffs on China made goods.

Departure of disgraced and fired TPG executive Bill McGlashan.

A TPG portfolio company once considered a governance darling now turned pariah.

Controlling shareholder TPG is exiting (reduced stake from 27% to 7% YTD, their Director recently resigned, and eliminated the Stockholders Agreement), putting the Board and executives in a vulnerable position to lose a potential proxy contest in 2020.

An activist that is intensifying their campaign and pushing for strategic alternatives.

Put it all together and ELF has put themselves into play whether they realize it or not. An activist settlement is the most reasonable outcome, because I doubt the Directors up for re-election (Sabrina Simmons, Kirk Perry, and Maureen Watson) are willing to stake their professional reputations to protect this management team, and have their oversight failings paraded around in a contested election. (Although anything’s possible I suppose.)

Activist Game Theory

Activist season is upon us and I figure it would be fun to deconstruct a potential activist situation that may play out in 2020. “Activist season” is a phrase I use to describe the time of year (typically around the holidays…fun!) when activists and targeted Companies are quietly maneuvering (possibly negotiating with each other) in anticipation of the Director nomination period when activists can submit nominees for a potential proxy contest.

Some current activist situations include:

Mednax and Starboard Director Nominations

CVS and Starboard Hold Amicable Talks

AT&T and Elliott Agree to Terms on Strategic Asset Review

Agilent and Pershing Square Stake

Often times, activist situations never reach the proxy fight stage and there’s usually a settlement with Board seats (see eBay and Papa Johns) granted to the activist. Settlements typically occur February through March, but timing depends on the Company’s fiscal year end and subsequent nomination window.

So why do companies settle? Activist game theory! It’s usually the most optimal outcome.

Spilling the Tea on ELF

There’s a lot of drama within the “Beauty Youtube” scene. Much of this drama is delivered in the form of “spilling the tea”.

“Tea” is another term for gossip, and it originated in black drag culture. It was referred to as T for “truth,” but it eventually evolved into “tea.” The term has thrived in this community and several drama channels name themselves a variation of it — HereForTheTea, TeaSpill, Mango Tea.

The act of creating drama by “spilling tea” ultimately drives audience engagement, product demand, and massive makeup sales.

Many of the key governance issues facing the ELF Board have already been laid out multiple times by Marathon Partners, but I don’t think anyone has really pieced it all together to explain why ELF is likely in checkmate if there’s a proxy contest. And as the stock continues to slide, it is becoming much more likely a challenge will happen. (I don’t know what will happen. This is my speculation.)

This is why I’m “spilling the tea” on ELF’s awful governance which has (in my opinion) been a material contributor to sideways stock performance since going public in 2016, and leaves the Company’s 2020 slate of Directors up for re-election very vulnerable to a successful proxy contest by an activist (if an activist chooses to contest the election). That said, a settlement is a more likely outcome.

ELF has this wonderful, inclusive brand slogan: “elf is for every eye, lip, and face”. That slogan may be true for their customers, but it has definitely not been the case for public shareholders. I suspect 2020 will be the year things finally begin to change in favor of shareholder inclusion.

Open Season on ELF

ELF has historically been under very tight control (i.e. ~27% ownership by TPG with the infamous Bill McGlashan in charge and 10%+ ownership by its CEO Tarang Amin) since going public in September 2016. But with TPG recently stepping off the Board, proactively exiting their stake, and terminating the Stockholders Agreement, 2020 will be the first year disgruntled shareholders will have real input into the Company’s strategic direction.

Before we get into the nitty gritty of Corporate Governance, let me introduce you to Jeffree Star and we’ll go from there. Hi, how are ya?

Jeffree Star

For those unfamiliar with the U.S. beauty market, Jeffree Star (pictured above) is one of the most influential, powerful, and (some say) controversial people in the industry.

An endorsement by Jeffree Star (“Jeffree Star Approved” Products) moves product and markets. And in 2019, ELF was a major beneficiary of Jeffree Star’s (unpaid & voluntary) endorsements.

While Kylie Jenner gets a lot of media and Wall Street attention for recently selling 51% of her cosmetics company to Coty for $600m, a couple Jeffree Star Youtube reviews (on putty primer and the general product line) earlier this year helped propel ~$500m in enterprise value gains and 70 bps of market share expansion this year to 4.7% for ELF (material for a small, single brand Company).

Quixotic Journey

My praise for Jeffree Star should not detract from the ELF team executing well in 2019 and creating a product line worthy of being “Jeffree Star Approved”, and winning over consumers with constantly shifting tastes. Their new Chief Marketing Officer, Kory Marchisotto, is a star in-the-making, and customers love ELF’s high-quality affordable products. The brand and operating model is well positioned, and not the reason the stock drags.

While I do believe CEO Tarang Amin does a good job when he’s focused and stays within his product management wheelhouse, a big drag on the stock is Mr. Amin’s multi-year quixotic journey to build a $1 billion multi-brand Company that has:

Produced no value since going public,

No credibility in the public market as a viable strategy,

Zero mandate from shareholders to continue pursuing it.

Given the Company operates a single brand, shareholders have every right to criticize the Company’s persistently bloated “multi-brand platform” cost structure.

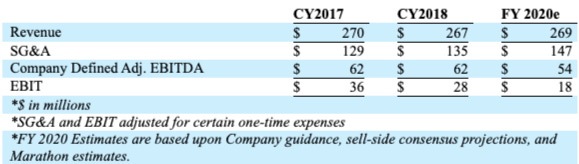

Borrowing Marathon Partners’ SG&A table from their most recent letter to the Board, ELF carries a robust $147M SG&A expense base with the activist believing the Company could cut $50M (or more) in operating expenses.

For context, here is ELF’s 2014 cost base before Mr. Amin began “investing” in the platform:

Before TPG’s acquisition and platform investment initiatives, ELF was operating at a ~$36.5M annualized SG&A run rate ($110.5M less than FY 2020E!), but let’s use the $51.4M 2014 SG&A expense for this quick look. Since December 2014 and applying FY 2020 estimates:

ELF has added ~$124M in incremental revenue.

While adding ~$96M in incremental SG&A over the same time frame.

The Company has essentially “re-invested” any-and-all operating leverage back into cost structure (and then some).

ELF’s cost structure was built with aspirations of being a $1B Company, and management has done little to acknowledge it needs to right-size the cost base to better align with a revenue run-rate that has remained flat at ~$270M since CY 2017.

As management pleads for patience on the strategy, ELF also collectively compensates senior leadership on par with Ulta’s executive team despite Ulta’s valuation being nearly ~19x larger.

It’s easy to advocate a strategy of patience and platform reinvestment when you’re paid like industry royalty and protected from outsiders. In its current configuration, ELF is essentially an executive compensation scheme funded by cosmetics sales.

Why e.l.f. Cosmetics?

As someone who traditionally sticks to “tech”, I love following online communities and observing the power of community driven demand. It’s the primary reason I occasionally end up in “consumer land”, and in this case, closely following ELF.

The situation at ELF was especially interesting to me when you consider:

Activist investor activity intensified following abysmal earnings in August 2018, and should pick up further in 2020.

The need to account for the impact of China tariffs and manage product pricing to offset them. ELF has done a good job managing the impact of tariffs to date.

An unexpected monetary settlement with the U.S. government regarding North Korea OFAC violations. A rare violation that came with a nonexistent disclosure to shareholders, and just before insiders sold shares to the public at $27 per share.

A CFO departure and corporate restructuring that entailed closing their retail stores.

The Bill McGlashan bribery scandal leading to his departure from the Board and TPG shifting to an “exit” mode in 2019.

Having followed activist/governance situations for a long time, that’s A LOT for any Board to absorb and makes ELF one of the more fascinating situations to follow.

Unfortunately, even if you believe the Board is trying their best to be stewards of the Company in the face of difficult circumstances, the governance lapses that surround these events exasperated problems and led to some very shareholder unfriendly decisions.

Small lapses in oversight compounded into a much larger existential problem at ELF and created a “governance Gordian knot” that can’t be removed without wholesale changes to the ELF Board and strategy.

With the recent termination of TPG’s Stockholders Agreement, which previously gave insiders insulation from frustrated shareholders, the Board is now exposed to a shareholder base that is finally empowered to drive change in 2020 and eager to cut the governance Gordian knot.

Governing Docs

Before we dive into the governance issues, a quick run down of the key governance documents and concepts:

Certificate of Incorporation: The legal document that creates the corporation and is like the “Constitution” of the Company. (more)

Bylaws: The set of rules and procedures for the internal functioning of an organization. It is the operating manual that governs the day-to-day workings of a company and must be consistent with Certificate of Incorporation. (more)

Stockholders Agreement: Arrangement among a company's shareholders that describes how the company should be operated and outlines shareholders' rights and obligations (normally Board seats). The agreement also includes information on the management of the company and privileges and protection of shareholders. (more)

Nominating and Corporate Governance (NCG) Committee Charter: Company’s Director nomination process, as informed by the governing docs and Stockholders Agreement, is delegated by the Board to the NCG committee.

The key to all of this is all governance mechanisms flow through the Certificate of Incorporation and Bylaws (the “governing docs”). Common sense stuff but I wouldn’t be writing this post if ELF Directors were making common sense decisions.

IF THERE ARE DISCREPANCIES BETWEEN COMPANY DISCLOSURES AND THE GOVERNING DOCS, ALWAYS RELY ON THE GOVERNING DOCS.

Yes, the Stockholders Agreement is a powerful document with references to the agreement in the governing docs, but the mechanism to fulfill governance obligations (like nominating candidates for Board seats) still flows through the governing docs.

And yet, ELF’s Company filings and proxy statement disclosures conflict with, if not mislead, what is actually written in the governing docs and Stockholders Agreement.

Why?

Discrepancy: TPG Designated “Directors” vs. “Nominees”

One of the key features of the Stockholders Agreement is granting Board representation to TPG with the number of “TPG Directors” based on share percentage ownership:

“TPG Director” is defined as “representatives designated by TPG” meaning a TPG Director does not need to be a TPG employee. An independent Director can be designated by TPG to represent the firm.

To place a TPG Designated Director onto the Board, the Stockholders Agreement requires the Company and parties to the agreement take all “necessary action” to:

“…include in the slate of nominees recommended by the Board for election as directors at each application annual or special meeting of stockholders at which directors are to be elected that number of individual designated by TPG that, if elected, will result in TPG having the number of directors serving on the Board that is shown [in the TPG percentage ownership table].”

A little wordy (like most agreements) but straightforward:

TPG designates a representative as a “TPG Director”.

The Board, using the nomination mechanisms laid out in the governing documents and committee charter, recommends TPG’s designated representative as a nominee for election at the annual meeting.

The annual meeting “results in” the TPG Director getting a Board seat (obligation fulfilled).

So why is ELF disclosing conflicting, if not misleading, information on an essential agreement between the Company and TPG in their most recent filings?

From their 2019 Proxy Statement:

TPG Growth has the right to designate a certain number of nominees for election to our Board, depending on the percentage of our outstanding common stock TPG Growth holds (as indicated in the table below).

TPG Growth’s nomination rights under the Stockholders Agreement allow for TPG Growth to unilaterally select its nominees. There are no restrictions on TPG Growth’s ability to nominate individuals that are partners, members, directors, officers, or employees of TPG Growth or its affiliates.

Notice the subtle inclusion of “nominees” in the percentage ownership table (there’s no good reason to alter the table) and explaining the rights TPG has through the Stockholders Agreement?

If you:

Didn’t notice “nominees”.

Didn’t pick up there is a difference between “nominees” and “directors”

Generally confused about what’s going on.

That is exactly how ELF wants you to feel.

What’s important to recognize here is “nominees” is a completely wrong interpretation of the Stockholders Agreement. (Hang in there! I get the punchline soon.)

The Stockholders Agreement clearly states nominees are recommended by the Board. There’s no separate, dual lane nomination process. I have no idea where this interpretation comes from.

The Certificate of Incorporation also codifies the Stockholders Agreement language in the governing docs:

“Because the TPG Investor is currently a stockholder of the Corporation and/or is entitled pursuant to the Stockholders Agreement with the right to designate members of the Board of Directors”

As I mentioned earlier, everything flows through the Certificate of Incorporation and Bylaws.

So why is ELF so wound up about adding “nominees” language and mentioning “unilateral” rights that conflict with the Stockholders Agreement and governing docs instead of just saying TPG has the right designate Board members?

Punchline: In my opinion, it’s an attempt to “reinterpret” the governing documents and Stockholders Agreement to justify the Board’s (incorrect) Director composition over the years and consequently gave TPG disproportionate power over the Board.

As Senator Howard Baker once said in regards to Watergate:

“It is almost always the cover up rather than the event that causes trouble.”

The disclosures weren’t always like this. Things changed after 2017.

Coincidentally, ELF’s governance troubles started on April 7, 2017 the record date of the 2017 Annual Meeting.

2017 Annual Meeting Record Date

ELF’s Company filings and proxy statement disclosures used to be consistent with the language in the Stockholders Agreement.

From the 2017 Proxy:

TPG Growth has the right to designate up to three members of our Board so long as it holds at least 30% of our outstanding common stock, two members of our Board so long as it holds less than 30% but greater than or equal to 20% of our outstanding common stock, and one member of our Board so long as it holds less than 20% but greater than or equal to 5% of our outstanding common stock. TPG Growth’s designees currently comprise three of our seven directors.

But disclosures started to “evolve” after the 2017 Annual Meeting and the “nominees” wording began appearing. From the 2018 Proxy:

TPG Growth has the right to designate up to three nominees for election…

I can’t emphasize how stunning this is to me. How can shareholders make informed decisions and, more importantly, trust management and the Board if they’re being given the wrong information?

It’s just one word, but “nominees” distorts how shareholders perceive the agreement if they only read the proxy and not the source document (Stockholders Agreement). It’s also the sort of misinterpretation that disenfranchises public shareholders and should have never happened.

So what occurred on April 7, 2017? A timeline:

Following the secondary share sale (at $27 per share…must be nice) by insiders which was completed April 5, 2017, TPG reduced its ownership interest in the Company from 42.3% to 29.6%.

Going under 30% ownership meant TPG was entitled to 2 TPG designated Directors on the Board (instead of 3) as of April 7, 2017 record date (for 2017 Annual Meeting).

Going into the 2017 Annual Meeting, there were already 3 TPG designated Directors on the Board (Bill McGlashan, Richard Wolford, and Maureen Watson).

This meant that in order to comply with the Stockholders Agreement, Maureen Watson (who was up for re-election at the 2017 meeting) should not be on the slate of nominees so that TPG’s representation is reduced to 2 TPG designated Directors following the 2017 Annual Meeting.

I think you know where this story is going.

3 TPG Designated Directors vs. 2 TPG Designated Directors

Instead of removing Maureen Watson, who was also Chair of the Nominating and Corporate Governance Committee at the time, off the 2017 nominee slate, the Board failed in their oversight of the Stockholders Agreement and Ms. Watson was nominated to the slate. This, in turn, resulted in TPG retaining 3 designated Directors following the 2017 Annual meeting when they were entitled to 2.

This was not a harmless mistake nor oversight and in fact an egregious lapse in governance. TPG is given a lot of power and rights over their designated Directors including certain voting powers, unilateral rights to remove and replace them, and the right to consider TPG interests when making Board decisions (i.e. alters the Director’s fiduciary duties). Retaining a third designated Director disenfranchised public shareholders.

The disclosure “distortion” only intensified after Marathon Partners first publicly identified the issue of “3 vs. 2 Designated Directors” early this year, and the Board doubled down on the wrong interpretation of the Stockholders Agreement, going as far as changing disclosure language in the 2018 10-K and subsequent quarterly filings this year (flagged by Marathon Partners):

ELF has effectively destroyed the governance foundations the Company was built on and eroded trust with shareholders. Instead of acknowledging mistakes and “doing the right thing”, they turned the situation into a governance Gordian knot.

ELF’s Governance Gordian Knot

At some point the Board needs to stop and ask themselves why this Company continues to be set back by years of corporate governance lapses which have culminated into the egregious situation we have today.

To date, the Board has provided vague answers and not addressed many of the key issues and questions brought up to date. Whether the Board wants to acknowledge them or not, bad governance decisions were made here, and they will be forced to answer these questions in a contested 2020 election.

Ms. Simmons, Mr. Perry, and Ms. Watson are up for re-election at the 2020 annual meeting, and will justifiably see extra scrutiny by shareholders for their corporate governance lapses during their tenure on the Board.

Sabrina Simmons

As Chair of the Audi Committee, Ms. Simmons will see scrutiny on:

Her handling of potentially false (and/or misleading, “half-truth”) statements & disclosures related to North Korea violations, regulatory compliance, and TPG designated director language.

Oversight of former CFO & President John Bailey’s 10B5-1 trading plan and liquidation of stock leading up to his announced March 2019 departure.

Kirk Perry

As Chair of the Compensation Committee, Mr. Perry will see scrutiny on:

ELF’s egregious compensation program.

Multi-year pattern of “Spring Loading” and “Bullet Dodging” equity grants, and Mr. Perry’s involvement in the 2019 grant. (Huge problem worthy of its own post)

Maureen Watson

As former Chair (and current member) of the Nominating and Corporate Governance Committee, Ms. Watson will see scrutiny on:

Her role in nominating herself to the 2017 slate.

Nominating Mr. Wolford to the 2018 slate.

Mr. Ellis’ appointment and nomination in 2019.

Handling of Stockholders Agreement amendments and interpretation of the Stockholders Agreement during her tenure.

Director Reputation Roulette

From the outside, it is impossible to pin fault or blame on the individuals directly responsible for the corporate governance lapses at ELF or why certain decisions were made. This would require a full investigation that I suspect the Board does not have the appetite to conduct, and likely requires a contested 2020 election to vote in a slate of candidates with a mandate to investigate and clean up governance.

Nevertheless, I can pin responsibility on the Directors who had oversight for these corporate governance lapses and the mistakes made under their watch.

If a contested election occurs, Ms. Simmon, Mr. Perry, and Ms. Watson all run the risk of damaging their professional reputations as shareholders, the media, and proxy advisory firms scrutinize their tenure.

It will be very difficult to win over Glass Lewis and/or Institutional Shareholder Services (ISS) given the governance lapses at ELF violate several proxy voting guidelines.

Even if the Company miraculously had the votes to win a contested election, the Directors up for election are playing reputation roulette, which leads me to believe the rational choice is to pursue a settlement over a proxy fight.

Termination of TPG Stockholders Agreement

The tipping point of (finally) writing this post occurred on December 5, 2019 when ELF filed an 8-K indicating:

TPG executive Stephen Ellis was stepping down from the Board.

TPG, CEO, and ELF agreed to terminate the Stockholders Agreement.

I don’t think investors fully appreciate nor understand what just happened. Look at the timing:

December 3, 2019: Marathon Partners files a letter pushing the Company to pursue strategic alternatives and criticizes ELF for not having customary automatic termination language in the Stockholders Agreement which would leave a perpetual shareholder unfriendly overhang on the Company.

December 4, 2019: TPG files a Form 4 indicating they have sold 3.6M shares, reducing their stake to 7.3%. Based on their selling pattern this year, I would expect TPG to completely exit their stake in ELF early March 2020.

One day after Marathon Partners’ public criticism, the Stockholders Agreement is terminated and TPG executive Stephen Ellis steps down.

Curiously, ELF also restates filings (same ones with designated “nominee” disclosure) adding reasonable assurance (a possible attempt to partially untie the governance Gordian knot) wording to their "Evaluation of disclosure controls and procedures over financial reporting" section.

TPG was under no obligation to terminate the Stockholders Agreement this early. I expected Stephen Ellis to step down in March 2020 after selling their last tranche of stock so was surprised by the optics of terminating early at Marathon Partners’ request.

Given the push for strategic alternatives, there’s also a possibility TPG does not want to be locked up and prevented from exiting in case of a prolonged process occurs. TPG may have also terminated the Stockholders Agreement to “clean slate” any potential strategic alternative process. If TPG holds their shares past early March 2020, that’s a big tell (they’re not holding shares simply to help CEO Tarang Amin).

Assuming TPG sells their last “tranche” (3.7M shares) in March 2020, they are selling to a frustrated shareholder base (2/3 of public investors did not support CEO Tarang Amin and Lead Director Beth Pritchard at the uncontested 2019 election) that will be pushing for a strategic alternatives process and change at the Board.

And finally, a potential “Blame Bill McGlashan” situation is the last thing TPG wants to deal with (in my opinion) and may privately implore ELF to settle things “quietly”.

Checkmate

Put it all together and ELF has put themselves into play whether they realize it or not. An activist settlement is the most reasonable outcome, because I doubt the Directors up for re-election (Sabrina Simmons, Kirk Perry, and Maureen Watson) are willing to stake their professional reputations to protect this management team, and have their oversight failings paraded around in a contested election.

The real question now is “What are the terms of settlement?”

Stay tuned.